Pioneer’s strategic planning process for the medium- to long-term future leverages a combination of internal proprietary scenarios in conjunction with expert analysis to assess potential implications to our business model. The scenarios reported below are from the International Energy Agency’s (IEA) World Energy Outlook (WEO) 2022, which examine a wide range of future pathways including consumer behavior, supply-and-demand, and related commodity and carbon pricing.

Since 1993, the IEA has provided medium- to long-term energy projections using the World Energy Model (WEM) – a large-scale simulation model designed to replicate how energy markets function. The WEM is the principal tool used to generate detailed sector-by-sector and region-by-region projections for WEO scenarios. We utilized the most current 2022 IEA scenarios in the company’s scenario analysis described in this report. We updated the scenarios published in last year’s Climate Risk Report with the current IEA scenarios and will continue to leverage this data in the future to forecast the potential impact on our company.

Additionally, Pioneer engages private commodity market research firms that provide industry outlooks and economic projections, which are used to test management’s assumptions of future business conditions. These tools are leveraged to assess potential impacts on global fossil fuel demand and our long-term business prospects, including key aspects of climate-related risks and opportunities.

Scenario Planning

The following scenarios were used for the purposes of the financial impact assessment summarized in this report. These scenarios reflect a production growth rate and cost structure that aligns to our publicly stated guidance and sustainability goals.

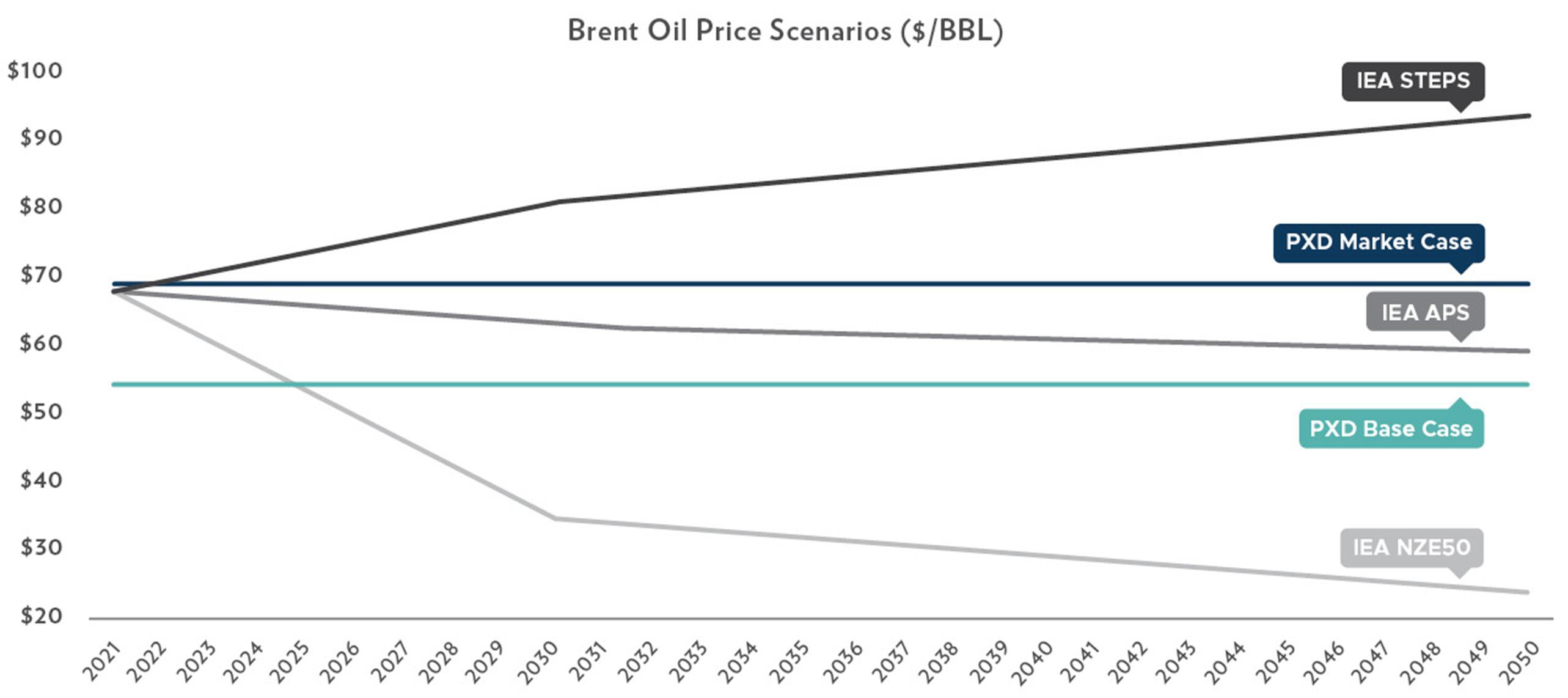

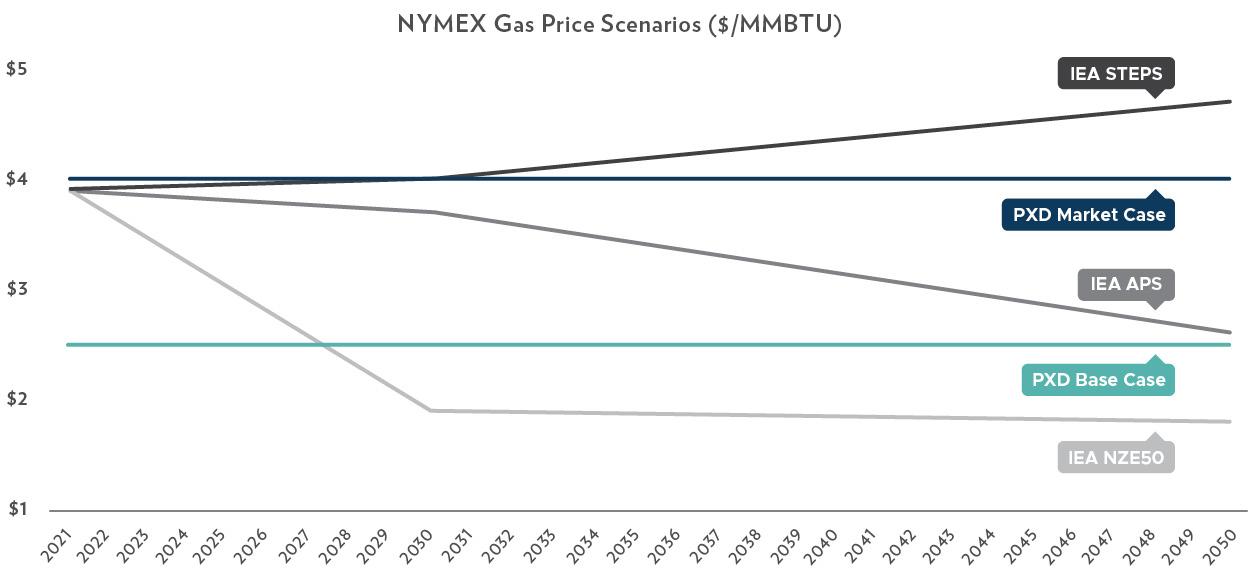

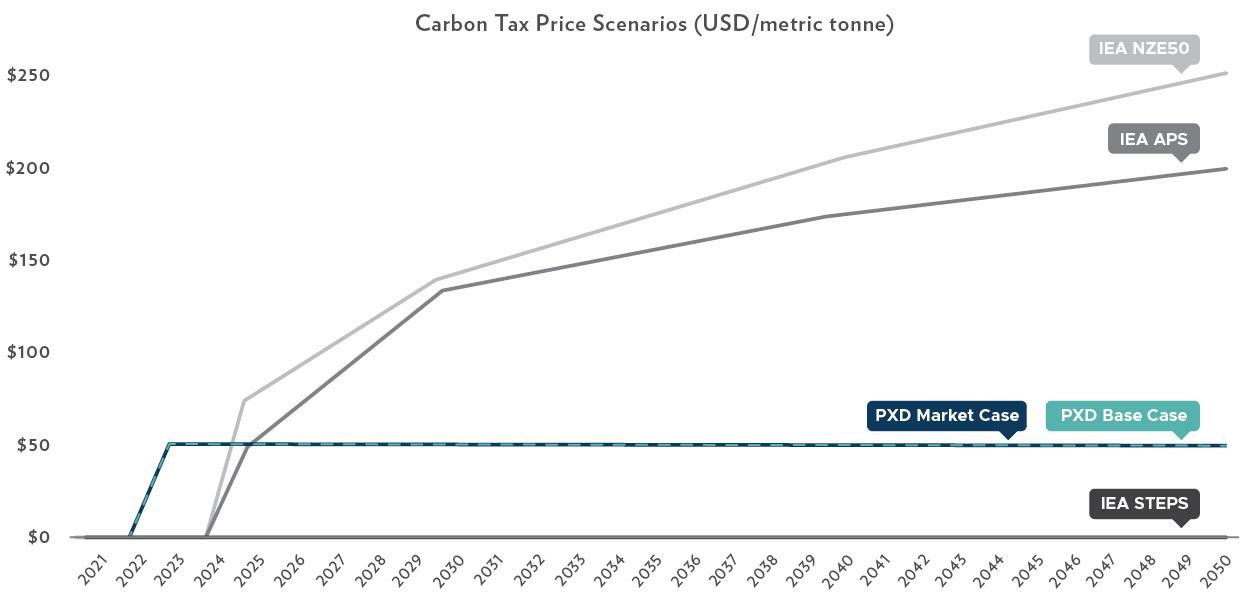

Pioneer Base Case

The PXD Base Case assumes a Brent oil price of $55 per barrel and NYMEX gas price of $2.50 per one million British Thermal Units (MMBTUs). The premise behind this scenario is supported by the view that oil and gas will remain a significant long-term source of global energy. This case is more conservative than current global pricing as we seek to ensure our investments are resilient even in a volatile pricing environment. Additionally, the PXD Market Case also includes Pioneer’s internal carbon price of $50 per tonne CO2e.

Pioneer Market Case

In 2022, we established a PXD Market Case that assumes a Brent oil price of $70 per barrel and NYMEX gas price of $4 per MMBTU that better reflects current commodity prices. This scenario is built on the premise that current trends of energy undersupply, inflation and lack of cohesive global emissions policies continue. The PXD Market Case also includes Pioneer’s internal carbon price of $50 per tonne CO2e.

IEA Stated Policies (STEPS)

The STEPS scenario reflects the direction in which current policy ambitions would likely take the energy sector. The scenario, updated in October 2022, only considers the specific policy initiatives announced to date, leading to a long-term temperature rise of 2.5 degrees Celsius in 2100.

IEA Announced Pledges (APS)

The APS scenario reflects the direction in which current government- announced pledges and targets would likely take the energy sector.

APS differs from STEPS because it assumes governments meet these targets regardless of having current policies in place to achieve them. The scenario, updated in October 2022, only considers the specific government pledges announced to date, leading to a long-term temperature rise of 1.7 degrees Celsius in 2100.

IEA Net Zero (NZE50)

The NZE50 scenario examines what additional measures would be needed beyond APS over the next 10 years to put global CO2 emissions on a pathway to net zero emissions by 2050. It is in line with the pathways used by the Intergovernmental Panel on Climate Change for the Special Report on Global Warming of 1.5 degrees Celsius (IPCC SR1.5). According to the IEA, the primary goal of the NZE50 scenario is to inform policy makers, as they have the greatest capability to move the world closer to its climate goals, and commitments made to date fall significantly short of what is required by the net zero pathway.