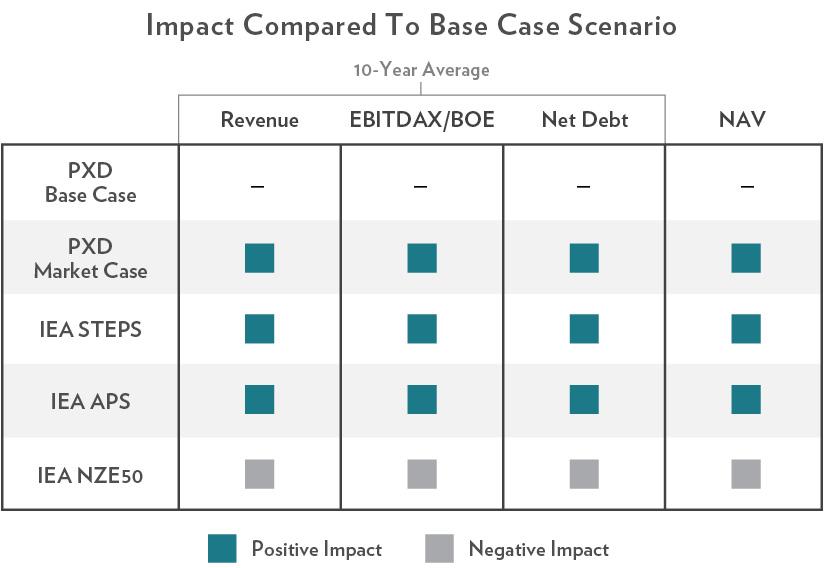

Pioneer leveraged the selected scenarios above to assess the resiliency of our business model and key financial metrics. We disclose the impact to revenue, EBITDAX per barrel of oil equivalent (BOE), net debt, and net asset value (NAV) relative to the PXD Base. We believe these metrics give a holistic picture of Pioneer’s inventory longevity and long-term financial health in a wide range of possible oil, gas and carbon pricing environments.

The table below highlights key observations from this analysis work.

The largest effect to these financial metrics is associated with commodity pricing. Pioneer maintains a conservative PXD Base case utilizing an oil price of $55 per barrel as we seek to test our investments against shifting pricing environments. Only the IEA NZE50 climate-focused scenario forecasts lower long-term commodity prices and, by extension, shows a negative impact to Pioneer’s future asset viability. To enhance our analysis, we include a Market Case that is more reflective of current market prices and serves as a comparison to the STEPS and APS scenarios. Pioneer may reassess its PXD Base and PXD Market commodity price assumptions in future reports as the market evolves.

The viability of Pioneer’s long-term business strategy was positively impacted by PXD Market Case, STEPS and APS scenarios. The company was most negatively impacted in the NZE50 scenario. This scenario focuses on outlining an ambitious pathway to keep global warming significantly below 2 degrees Celsius by 2050. Nevertheless, Pioneer seeks to comprehensively stress-test our business strategy. Evaluating net zero pathways is an important measure towards understanding the robustness of our assets across a wide range of pricing environments and assessing alternative business strategies in the case that primary energy demand shifts nearer to this pathway.

In contrast to commodity pricing, carbon pricing had only a minor impact on EBITDAX per BOE due to Pioneer’s focus on minimizing its carbon emissions. Pioneer has one of the lowest Scope 1 and Scope 2 emissions intensities among producers in North America. Our emissions intensity is expected to further improve as we progress our emissions-reduction strategies. It is important to note that Pioneer’s carbon pricing analysis is attributed only to Scope 1 and Scope 2 GHG emissions (not Scope 3).

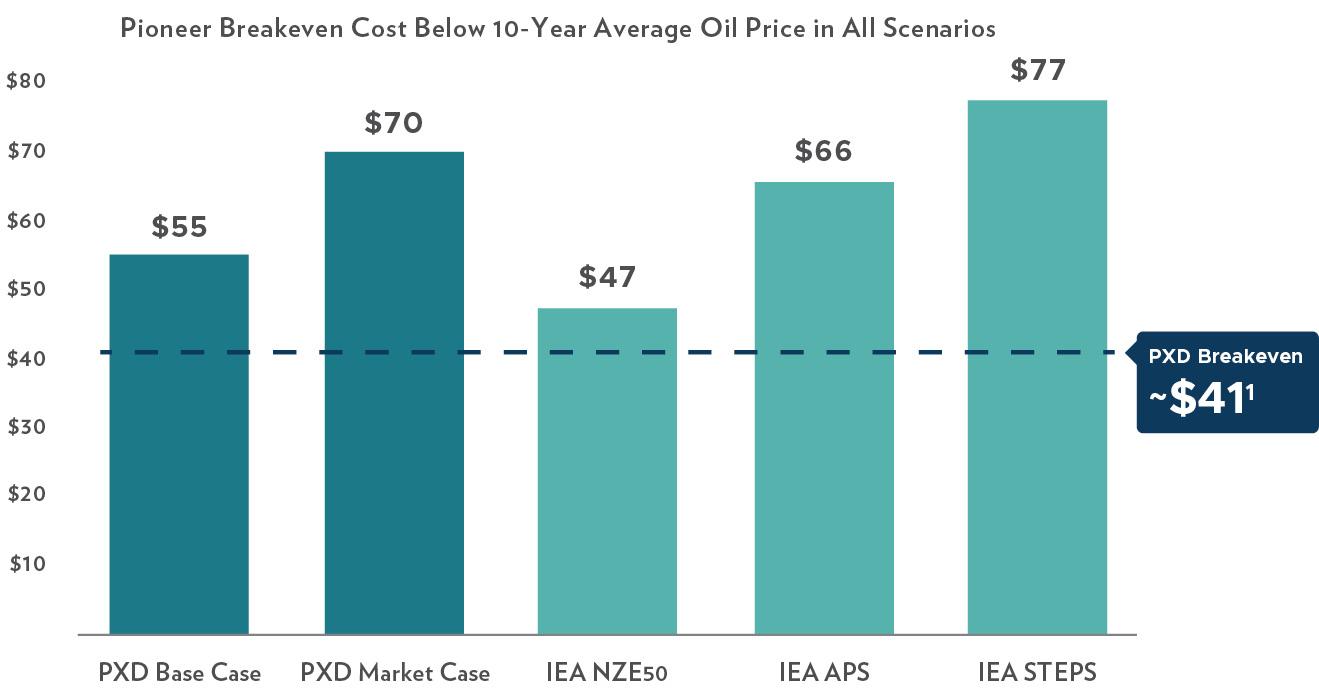

Pioneer’s 2022 wellhead breakeven price is below the 10-year average oil price in all the modeled scenarios. As continued efficiencies and benefits of scale are realized, Pioneer’s assets are expected to remain competitive even in volatile pricing environments, implying Pioneer should be able to produce our assets profitably over the short- and medium-term.

Low-Cost, Low-Emission Resiliency

While the IEA scenarios offer potential future outcomes, they are not the only possible outcomes. There remain a wide range of climate policy, technical innovation and geopolitical forces that could shape future commodity prices. For that reason, Pioneer uses other internal and external forecasts to test its strategy. Based on our robust scenario planning, we believe Pioneer is in a strong position to navigate future scenarios due to the quality of our assets paired with our strong balance sheet, low-cost structure, low emission intensity, and ambition for net zero Scope 1 and Scope 2 GHG emissions by 2050.

Additionally, Pioneer seeks to reflect the results of these scenarios in our corporate strategy. We take climate-related issues into account in our strategic planning by:

- Establishing an internal carbon price of $50 per tonne CO2e on Scope 1 and Scope 2 emissions to test the resiliency of our investments against shifting regulation and to support our emissions targets

- Focusing on low-cost, low-carbon-intensity assets that will remain competitive and return value to investors even in volatile pricing environments

- Evaluating acquisition opportunities that demonstrate continued growth in a low-carbon world

- Developing long-term global demand models for oil and gas to assess the impact of evolving energy transition technologies

- Investing in key energy transition technologies through (i) partnerships with third-party investment funds focused on energy transition opportunities and (ii) contracting for renewable power

- Electrifying our operations to reduce emissions

- Performing routine risk assessments to identify and evaluate the impact of emerging climate challenges on our business model and operations, including enhancing our physical risk assessment process

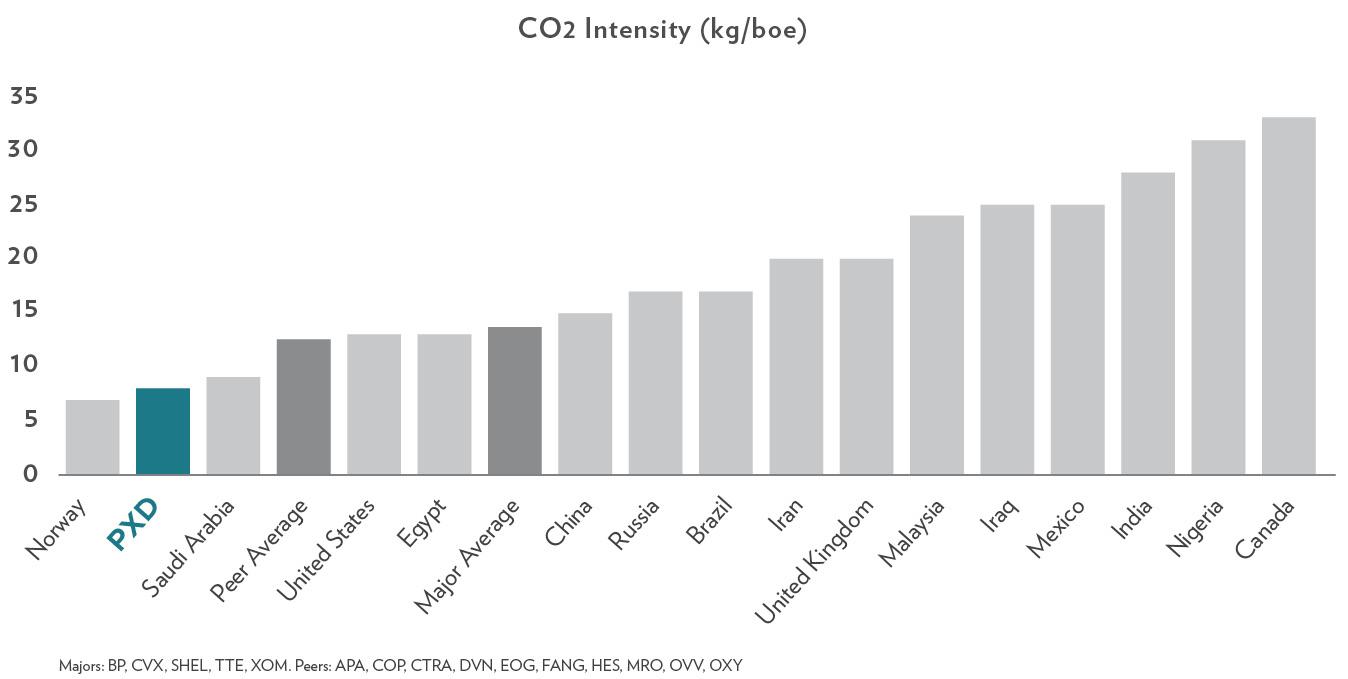

Many of the scenarios evaluated forecasted a continuing need for responsibly sourced oil and gas in the coming decades, and it is those companies with the lowest-cost, lowest-emission-intensity barrels that are expected to retain their social license to operate. As shown in the chart on p. 8, Rystad Energy estimates that Pioneer has one of the lowest CO2 intensities per barrel equivalent in the world.

Combining this with our low breakeven price is critical when evaluating Pioneer’s viability in a decarbonizing world. In the most carbon-constrained scenario analyzed, NZE50, the IEA forecasts that oil prices will decline over the next several decades and that global oil production will decline to 22 million barrels of oil per day (MMBOPD) in 2050 compared to 90 MMBOPD in 2021. This implies that only the lowest-cost, lowest-emissions-intensive producers like Pioneer will remain viable in NZE50.

Additionally, Pioneer believes that we can maintain our low-cost leadership by combining our top-tier acreage position in the Permian Basin with our top-quartile drilling, completions, operations and supply chain performance, as well as industry-leading corporate overhead and interest costs. We expect to continue to improve our cost structure through efficiency improvements and adoption of new technologies in our operations, allowing Pioneer to remain resilient even if demand erodes as the energy transition gains momentum.

While our short- to mid-term strategy focuses on maintaining industry-leading margins and low-emissions-intensive operations, our long-term strategy also includes establishing an investment program to capitalize on opportunities arising from the energy transition. Pioneer is partnering with select firms that have expertise in evaluating, executing and managing alternative energy investments. Through capital committed to these partnerships, as well as opportunistic direct investments, Pioneer seeks to participate in energy transitionopportunities driven by the energy transition and capture business opportunities by funding early-stage companies and piloting emerging technologies aimed at reducing emissions and improving efficiencies. Our investments center on key transition pillars, including battery storage; wind and solar renewable energy; hydrogen; carbon capture, utilization and storage; and carbon offset generation. We believe these investments are a crucial step towards seeding the next generation of low-carbon opportunities for the company and paving the way for a responsible, sustainable energy transition.

While we plan to continue building our investment strategy, Pioneer has already dedicated capital to select opportunities that include:

- Providing seed funding to one of the largest designers and integrators of battery storage solutions in North America

- Leveraging our existing surface ownership position to evaluate and develop renewable energy projects, such as wind and solar generation to be utilized by our operations as well as the electrical grid in the state of Texas

- Pursuing a field electrification strategy that includes expanding on our legacy electric infrastructure in order to move to field-related activities to a grid-power driven, low-carbon field of the future, with a near-term focus on electrifying drilling and completions operations

- Providing funding for the development of nature-based carbon credit exchanges and accreditation mechanisms to support long- term, scalable carbon-capture solutions

- Piloting technologies to desalinate produced water as part of our holistic approach to environmental stewardship that may allow for reuse opportunities beyond oil and gas, including agricultural uses